Table of Contents

How to Check if Your UK-Manufactured Vehicle Qualifies for 0% Import Duty

Importing a vehicle from the United Kingdom to Australia can deliver significant savings when structured correctly. Under the Australia-United Kingdom Free Trade Agreement which came into force in May 2023, vehicles that are manufactured in the UK are eligible for 0% import duty, removing the standard 5% customs tariff.

However, a British brand badge alone is not enough. To qualify, the vehicle must be physically manufactured in the United Kingdom and supported by appropriate origin documentation.

One of the ways you can check eligibility before shipping is by reviewing the vehicle’s VIN (Vehicle Identification Number). Below is a practical and structured VIN verification guide.

What ‘Duty-Free’ Means

Under the UK-Australia Free Trade Agreement:

✓ The standard 5% import duty is not applicable.

⚠ 10% GST still applies

⚠ Luxury Car Tax (LCT) still applies for vehicle values over AUD $80,867.00

For higher-value vehicles, this 5% duty saving can represent many thousands of dollars.

VIN Verification: Step-by-Step Eligibility Guide

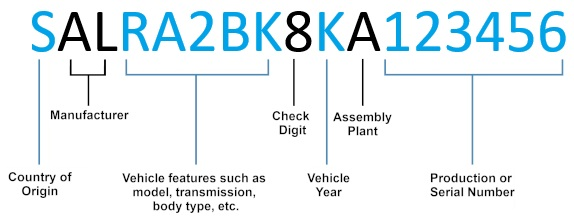

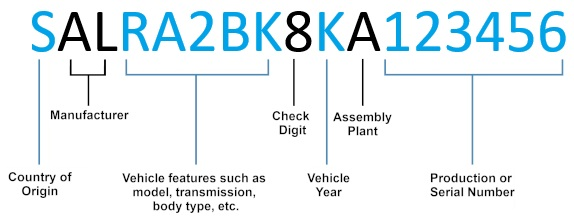

The 17-digit Vehicle Identification Number (VIN) contains structured manufacturing data that identifies the country of production, manufacturer, model year and assembly plant. One of the most reliable ways to determine whether a vehicle was manufactured in the United Kingdom is by analysing its VIN.

Step 1: Check the First Character (Country Code)

Eligible – VIN begins with: S (United Kingdom). If the VIN does not start with an S, the vehicle was not manufactured in the UK.

Step 2: Verify the World Manufacturer Identifier (WMI)

| Manufacturer | WMI Prefix | Example UK-Built Models |

|---|---|---|

| Land Rover | SAL | Range Rover, Defender, Discovery |

| Jaguar | SAJ | F-Pace, XF, F-Type |

| Mini | SMM | MINI Hatch (Oxford) |

| Bentley Motors | SCB | Continental GT, Bentayga |

| Aston Martin | SCF | Vantage, DB11 |

| Rolls-Royce Motor Cars | SCA | Phantom, Ghost |

| Lotus Cars | SCC | Elise, Emira |

| McLaren Automotive | SBM | 570S, 720S |

| Nissan Motors UK | SJN | Qashqai, Juke |

| Toyota Motors UK | SB1 | Corolla (UK production) |

Note: If your VIN starts with W (Germany), V (France/Spain), or J (Japan), your car was likely manufactured outside the UK and the standard 5% duty will apply

Step 3: Low-Volume British Manufacturers

Manufacturers producing fewer than approximately 500-1,000 vehicles annually use a modified VIN format. Examples include Caterham Cars, Morgan Motor Company, Noble Automotive and Ginetta Cars. Because these vehicles are hand-built, Australian Border Force may request additional manufacturer confirmation.

The third character is typically 9, resulting in SA9.

Step 4: Confirm the Assembly Plant (11th Character)

The 11th character of the VIN identifies the vehicle’s assembly plant. This is particularly important for manufacturers that produce the same model in multiple countries.

- Land Rover – A = Solihull; H = Halewood

- MINI – T or 2 = Oxford, UK; 3 = Netherlands

- Nissan (UK) – U or N = Sunderland

- Jaguar – B = Castle Bromwich; H = Halewood

- Honda (UK) – U = Swindon (production ended in 2021)

- Vauxhall – E or X = Ellesmere Port; V or Y = Luton (Luton production ended in 2025)

- Toyota (UK) – X = Burnaston, Derbyshire

- Lotus – H = Hethel, Norfolk

- Bentley – C = Crewe, Cheshire

- Rolls-Royce – G = Goodwood, West Sussex

- Aston Martin – G = Gaydon, Warwickshire; S = St Athan, Wales

Confirming the plant code ensures the vehicle is genuinely UK-built.

Real-World VIN Examples

Example 1 – Solihull Production Land Rover

S = United Kingdom

SAL = Land Rover UK

K = Model year

A = Solihull plant

This vehicle was built in Solihull, England and would likely qualify for duty-free import (subject to documentation).

Documentation Requirements

Under the Australia-United Kingdom Free Trade Agreement, a traditional government-issued Certificate of Origin is not required.

Instead, preferential tariff treatment can be claimed using a declaration based on Importer’s Knowledge.

We include this form as part of our UK documentation checklist and assist our clients in completing this declaration correctly prior to shipment, ensuring required wording and origin details are properly documented.

Importers must retain supporting documentation like the V5 and be prepared to substantiate the origin if requested by Australian Border Force.

It is also advisable to keep the original UK V5C logbook available, as VIN and production details may be cross-referenced during customs clearance.

Full-Service, Door-to-Door Vehicle Import Solutions

Importing a vehicle from the UK to Australia involves regulatory approvals, export processing, shipping coordination, customs clearance and quarantine management.

Autoshippers provides complete end-to-end management including Vehicle Import Approval (VIA) applications, secure vehicle collection across the UK, UK export clearance, international shipping, Australian customs clearance and quarantine and biosecurity coordination.

Each stage is managed carefully to ensure compliance and smooth delivery.

Frequently Asked Questions – Duty-Free Car Import to Australia

What does “duty-free” mean when importing a car to Australia?

“Duty-free” refers to the removal of the standard 5% import duty under the Australia-United Kingdom Free Trade Agreement. It does not mean tax-free.

- 10% GST still applies

- Luxury Car Tax may apply where relevant

Does a British brand automatically qualify for duty-free import?

No. A British badge is not enough. The vehicle must be physically manufactured in the United Kingdom to qualify under the Free Trade Agreement. Manufacture location, not brand origin, determines eligibility.

How can I check if my vehicle was manufactured in the UK?

One of the ways you can check is by reviewing the VIN (Vehicle Identification Number).

- The VIN should begin with “S” (United Kingdom country code)

- The first three characters (WMI) should match a recognised UK manufacturer

- The 11th character confirms the assembly plant

VIN verification is an important screening tool, but proper origin documentation must also be retained.

Is a Certificate of Origin required?

No. Under the Australia-United Kingdom Free Trade Agreement, a traditional government-issued Certificate of Origin is not required. Preferential tariff treatment can instead be claimed using a declaration based on Importer’s Knowledge.

Autoshippers assists clients in preparing this declaration correctly prior to shipment.

How do Customs value my car for duty if I don’t have an invoice?

Australian Border Force (ABF) normally determines the customs value using the transaction value method, which is based on the price actually paid for the vehicle. To apply this method, you must provide documentation such as:

- Invoice or bill of sale

- Proof of payment

- Registration papers

- Service records

- Shipping Bill of Lading

- Passport (where applicable)

The purchase price is converted to Australian dollars using the official exchange rate on the date of export. That converted amount becomes the customs value for calculating duty and GST.

Where sufficient documentation is not available, or where an alternative valuation approach is more appropriate, an independent expert appraisal may be required to establish the customs value at the Australian port of importation (the vehicle’s landed condition).

Should I get a valuation on arrival?

In most cases, yes. We recommend arranging an independent valuation on arrival, particularly where the vehicle may have depreciated since purchase. A compliant appraisal reflecting the vehicle’s landed condition can result in a lower customs value, which may reduce GST and any applicable duty.

Autoshippers can arrange an independent valuation through our customs approved specialist partners in Australia. This ensures the valuation meets Australian Border Force requirements and accurately reflects the vehicle’s condition at the time of import.

What documents should I retain?

You should retain:

- Your completed Importer’s Knowledge declaration

- Supporting origin documentation

- The original UK V5C logbook

- The Bill of Lading, this will be the legal shipping document we send to you after the vessel has sailed.

Customs may cross-reference VIN and production details during clearance.

Can Autoshippers help with eligibility and documentation?

Yes. Autoshippers can:

- Review your VIN

- Confirm UK manufacture indicators

- Assist with Importer’s Knowledge declarations

- Arrange compliant vehicle valuations on arrival

- Manage the entire import process door-to-door

About Autoshippers

Autoshippers is a specialist international vehicle logistics provider focused on UK-to-Australia vehicle imports.

We assist private importers, returning residents, collectors and dealerships with structured, compliant solutions. Our expertise includes VIN eligibility checks, FTA origin documentation guidance, export handling, freight coordination, customs clearance and quarantine management.

With experience handling UK-manufactured vehicles across brands including Land Rover, Jaguar, Bentley Motors and Aston Martin, Autoshippers ensures each shipment is managed professionally and in full compliance with Australian regulations.

From eligibility verification through to final delivery in Australia, we provide clarity, structure and confidence throughout the entire process.

Find out more about costs and shipping services to Australia.